A favorite Wall Street Journal columnist, James Mackintosh, quotes an economist saying that because the price‐earnings ratio for stocks rises when bond yields fall, "The most capitalist valuation metric in the world, the P/E of the S&P 500, is now just completely dominated by monetary policy."

That would make sense if increases in the Fed's policy rates were matched by increases in 10‐year bond yields. On the contrary, bond yields have instead fallen from 3.49% on June 14 when the fed funds rate was 0.33 to 2.78% on August 10 when the funds rate has risen to 2.32%.

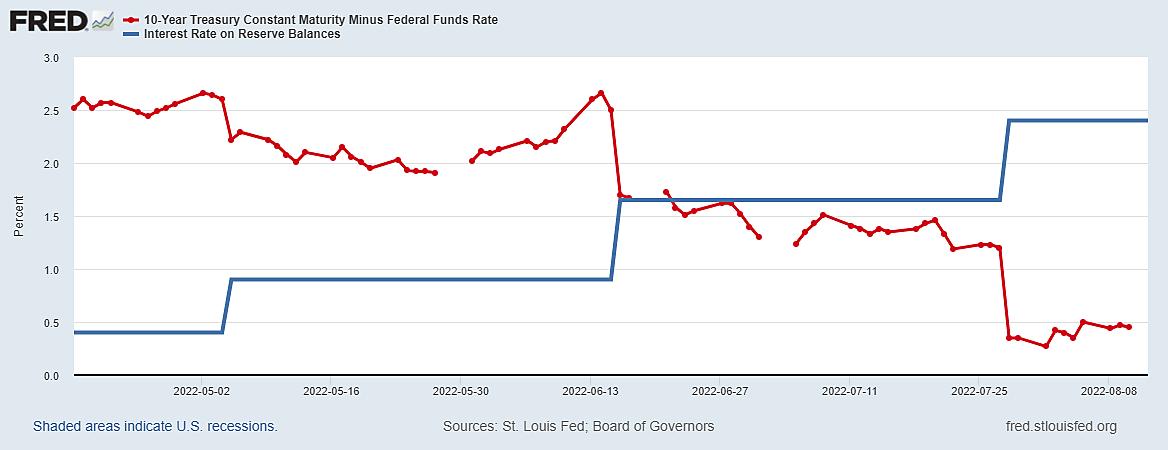

The red line in the graph shows how the spread between the yield on 10‐year bonds and the rate on overnight fed funds has now narrowed to the point where that key yield curve is nearly inverted–something that has never happened without a recession in the near future.

The blue line shows the interest rate the Fed pays to banks as a reward for holding reserves at the Fed. Since the IOR is set 10 basis points below the top fed funds rate, the blue line also shows when the FOMC raised the funds rate.

Another thing that never happened was a postwar recession in which the Fed did not cut the federal funds rate. In 1980, for example, the Volcker Fed slashed the fed funds rate from 19.9% in early April to 8.6% by early June–a record rate cut never matched before or since (and often wrongly ascribed to "the late seventies" by revisionist monetary historians).

In fact, the Fed takes pride in its institutional history of pushing the fed funds rate up and down in dramatic, reactive waves.

In 21st Century Monetary Policy (p. 315), former Fed Chairman Ben Bernanke notes that before the Great Recession happened on his watch, "the Fed typically responded to recessions by cutting the funds rate by 5 to 6 percentage points." He laments that with a fed funds rate of just 5.25 in July 2007 "conventional short‐term rate cuts obviously would not provide enough ammunition to deal with a typical recession" (though the Bernanke Fed did, in fact, cut the 5.25% rate by 5 percentage points).

But how could the Fed have repeatedly cut the funds rate by 5 to 6 percentage points (or 10 points in 1980) unless it had first pushed that rate high enough–as it did in 2006–07–to risk another "typical recession"?

Mr. Mackintosh sees "plenty of straws in the wind to indicate that an economic slowdown is underway" and warns of "the risk that slowdown turns to recession." Yet he insists, "There's no sign the Fed will change its mind and agree that rates should come down again next year" (much not keeping raising rates this year). On the contrary, the narrowing spread between the fed funds rate provides a glaring sign that the Fed cannot always get what it wants–that the global market for U.S. bonds can indeed "fight the Fed" (and win, with or without recession).

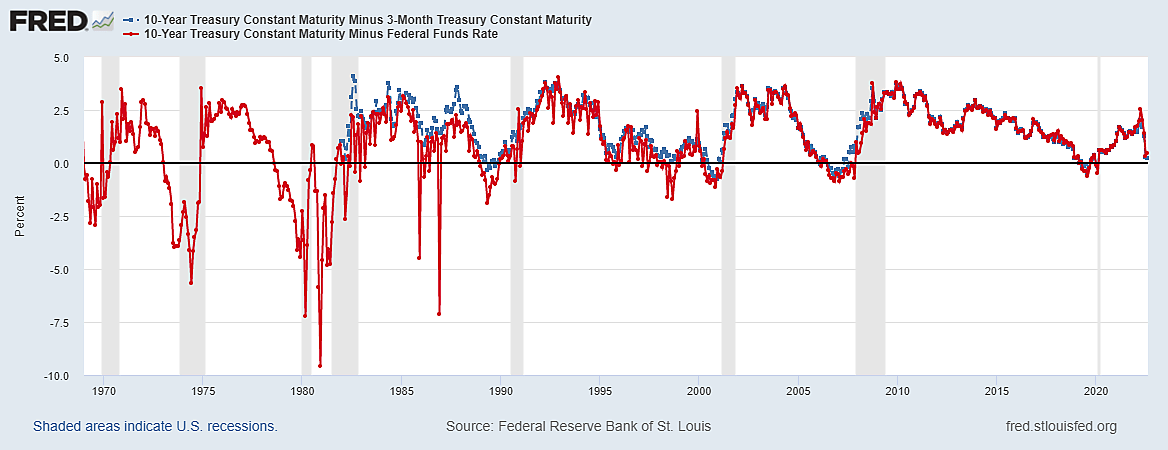

Three large increases in the fed funds rate left the 10‐year bond yield unphased, hovering around 2.7–2.9%. Since there is no reason to assume that is about to change, FOMC hawks and their fans who anticipate a fed funds rate of 3.25–4.0% in the fourth quarter are effectively predicting a deeply inverted yield curve: the one‐day funds rate and 3‑month T‑bill would then pay a substantially higher interest rate than a 10‐year bond.

Inverting those yield curves has always been followed by recession, with a lag. The only apparent exceptions were brief and rare "soft landings" when the Fed stopped inversion by cutting the funds rate before recession began–such as 2018–19, October 1998, and the end of 1985 and 1986.

The prospect of unsustainable yield curve inversion points to two alternative scenarios is which stock and bonds markets (which share the same information) could end up being correct about stubbornly low long‐term bond yields keeping the fed funds rate from rising nearly as much as "hawkish" observers might wish or imagine.

In the first scenario–called a soft landing–the FOMC would become worried about yield curve inversion soon enough to "pause" and stop raising the fed funds rate, keeping it slightly below the bond yield and they did in 2018–19.

In the second scenario–a hard landing–significant and sustained yield curve inversion is followed by a recession that eventually compels the Fed to "pivot" and start bringing the fed funds rate down quickly. Recessions also cut bond yields by reducing expected future fed funds and T‑bill rates, but because the funds rate falls more than the yield that ends the inversion and the steeper yield curve promotes bank lending and economic recovery.

Although waiting for a serious recession before reversing Fed rate hikes seems to be thought of as more "hawkish" than a preemptive soft‐landing pause, such stop‐go extremes usually end with a much lower fed funds rate for years. The funds rate fell from 6.5% to 1% after the so‐called 1999–2000 "tightening" cycle, and from 5.25% to zero after the 2006–2008 disaster of adding rising interest rates to soaring oil prices. Any cyclical price relief from "going out of business sales" in Fed‐related recessions soon evaporates with the zero‐rate stimulus that follows.