The policy-induced recession that began in February may already have ended but the devastating impact of government shutdown policies are likely to linger for many quarters. There are growing signs that the path towards reopening of the economy is setting the stage for growth, but significant risks remain.

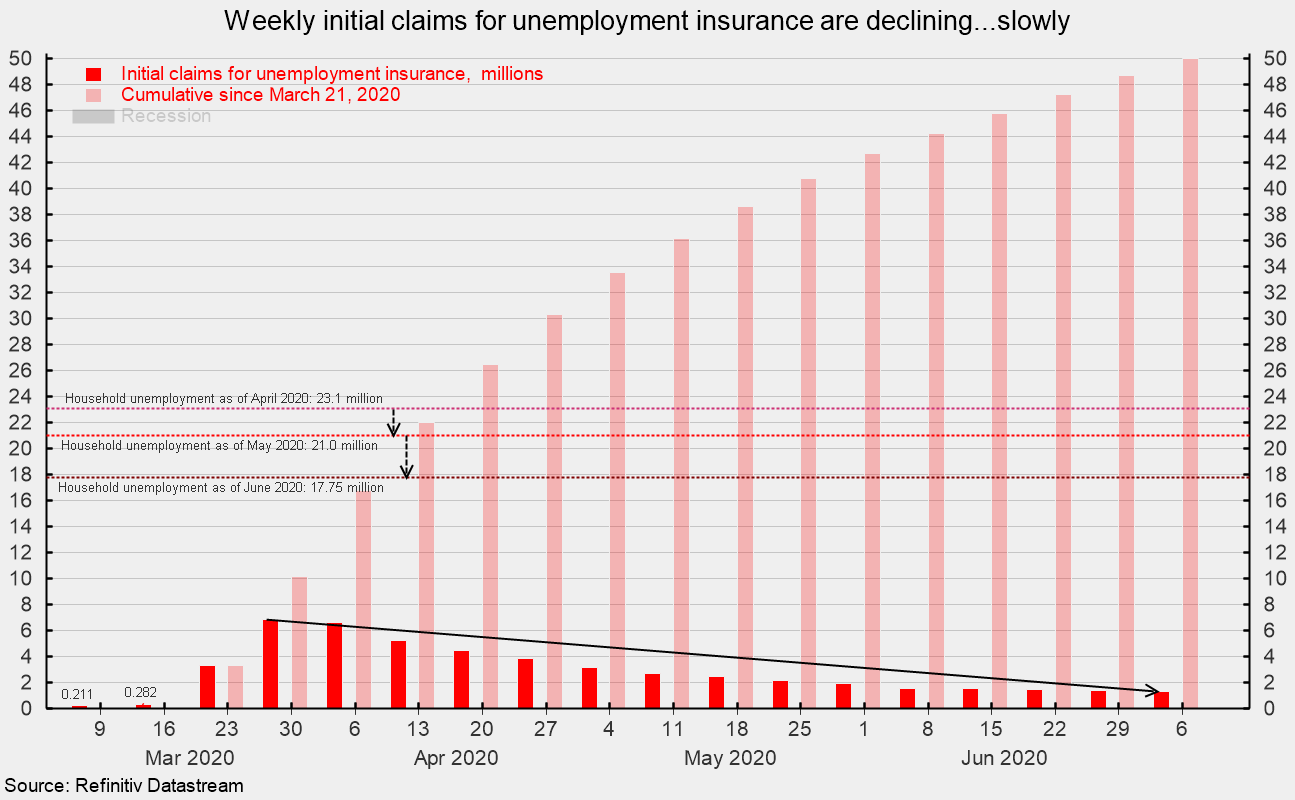

For the labor market, initial claims for unemployment insurance totaled 1.31 million for the week ending July 4 (though holidays can distort the numbers), marking the sixteenth consecutive week of historically massive layoffs following the implementation of business and consumer lockdowns intended to fight the COVID-19 pandemic (see chart). However, claims have slowed for the fourteenth straight week after registering 6.87 million for the week ending March 28 and have been below 1.5 million for three consecutive weeks. Claims in the millions are still extremely high by historical comparison but the downward trend is a positive sign. Still, the 16-week total of 50 million is devastating.

The national Employment Situation report for June was released on Thursday, July 3 and showed a gain of 4.8 million in nonfarm jobs following a 2.7 million rise in May, as reported in the establishment survey portion of the report. Total unemployed in June was 17.745 million, down from 21.0 million in May and 23.1 million in April (see chart), as reported in the household survey portion of the report.

The unemployment rate fell to 11.1 percent (though the Bureau of Labor Statistics noted that improper responses likely underreported the rate and is likely about 1 point higher, near 12 percent) versus 13.3 percent in May. The previous cycle peak in the unemployment rate was 10 percent in October 2009 while the highest unemployment rate since 1950 came in November 1982 at 10.7 percent. Though data collection was much less reliable, the unemployment rate following the Great Depression was estimated to have peaked at about 25 percent in 1933.

Declining initial claims for unemployment insurance combined with two consecutive months of gains in payrolls could be early signs that the recession is nearing an end (or possibly already has ended, through the official determination by the National Bureau of Economic Research is likely many months or quarters away). However, the surging number of new COVID-19 cases across most of the nation is a major risk to the nascent recovery. If the resurgence of the virus leads consumers to retrench or policymakers to backtrack on plans for reopening the economy, growth could be choked off.

Robert Hughes joined AIER in 2013 following more than 25 years in economic and financial markets research on Wall Street. Bob was formerly the head of Global Equity Strategy for Brown Brothers Harriman, where he developed equity investment strategy combining top-down macro analysis with bottom-up fundamentals. Prior to BBH, Bob was a Senior Equity Strategist for State Street Global Markets, Senior Economic Strategist with Prudential Equity Group and Senior Economist and Financial Markets Analyst for Citicorp Investment Services. Bob has a MA in economics from Fordham University and a BS in business from Lehigh University.