In a world of sane energy policy, the following three precepts would take pride of place: (1) the forces of supply and demand would allocate scarce energy resources to their best possible use; (2) constant competitive pressures should lead energy suppliers to reduce their costs of extraction, refinement, and sales, just as it should lead purchasers to economize on the use of fuels; and (3) a set of careful taxes and restrictions should be imposed proportionate to measurable externalities, and only where the benefits from government imposition exceeded the costs of running the regulatory system. The combination of market and regulatory measures is not perfect, but it should lead to steady improvements, as the price system should prove resilient enough to absorb the full range of exogenous shocks, whether from natural events like storms and volcanoes or from political sources like the stress of the Russian invasion of Ukraine.

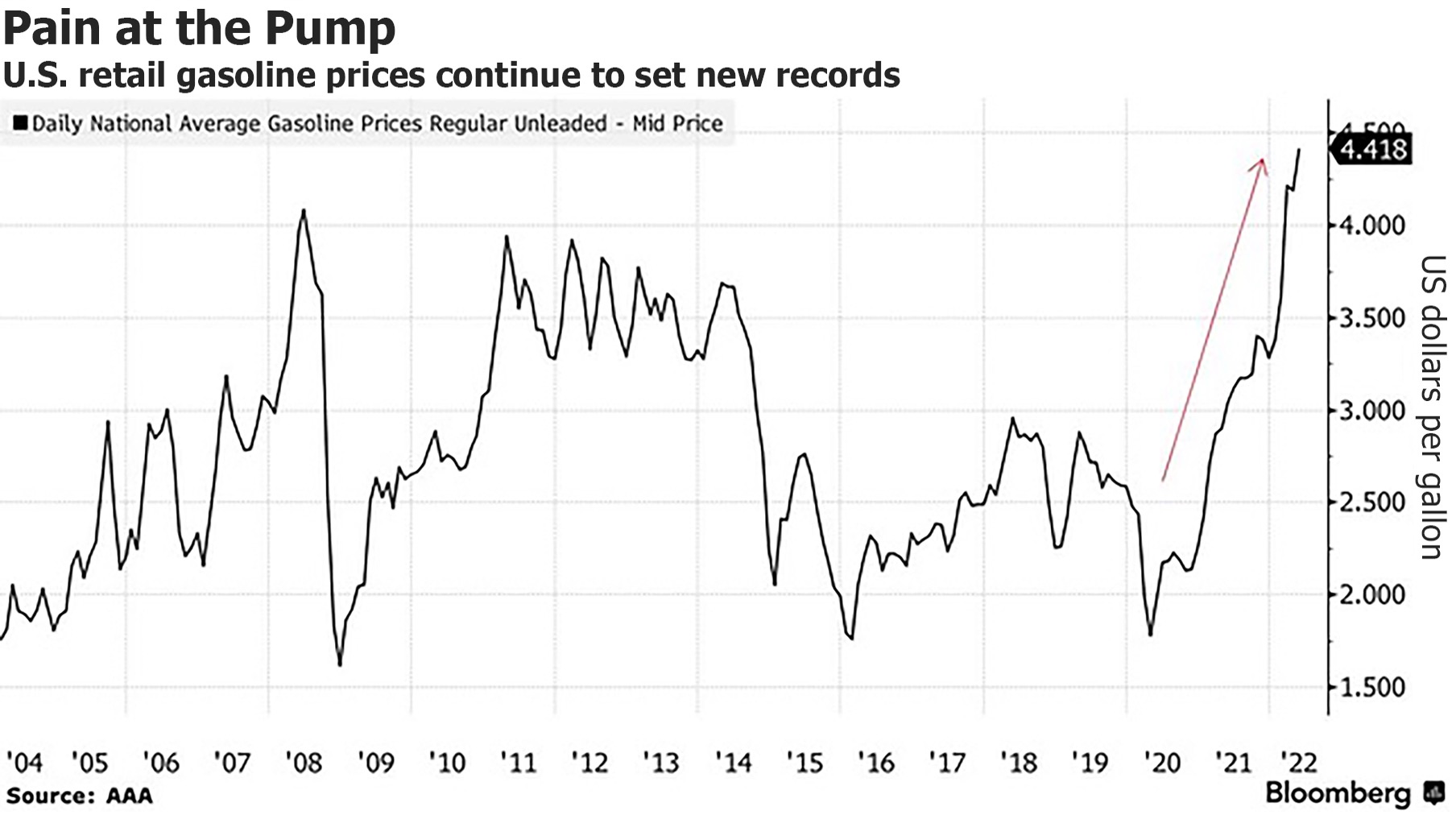

By every measure, the energy market is fraught with vulnerabilities, virtually all of which stem from high levels of government interference in the production, distribution, and sale of goods. The source of the distress is the unannounced, but readily apparent, decision of the Biden administration to dethrone fossil fuels from their central position in energy markets. There is no single tool used to achieve this end, and certainly no explicit acknowledgement of the overall agenda. But the dire consequences of these policy changes become more evident by the day. Multiple reports point to systematic shortages in diesel fuel nationally, but particularly in the Northeast, where refining capacity is down by half from 2009. The national diesel fuel shortage will start this summer and continue indefinitely. Right now, the electricity industry also faces planned and unplanned blackouts because of a decline in energy sources from nuclear and coal, which is placing excessive dependence on unreliable wind and solar sources. Gasoline prices have already spiked to record levels, most recently at $4.43 per gallon and climbing, driving a core inflation rate over 6 percent, while the energy inflation rate remains over 30 percent per year.

In the face of this energy crisis, the one imperative is to increase the supply of energy to both meet the post-COVID jump in demand and fill the supply gap left by the much-needed strategic effort to shut down Russian natural gas sales to the West. However, the Biden administration has not taken any steps to bring more US energy online in the short run.

One striking development was the administration's recent announcement that it had canceled the proposed oil and gas leases in excess of one million acres in the Cook Inlet in Alaska and in the Gulf of Mexico "[d]ue to a lack of industry interest in leasing" these potential sites. This lame excuse is too true, but for all the wrong reasons. One might ask the Biden team: why does the entire industry have no interest in leasing new sites when high prices signal robust demand?

The explanation is that the successful bidder will face a nonstop set of legal challenges from environmental groups and a series of unidentified obstructionist actions from the Biden administration reflecting its hostility to fossil fuels. This hostility has been evident ever since the administration posited a set of climate change objections to fossil fuels when it nixed the Keystone XL pipeline on its first day in office. Yet, at the same time that these oil and gas leases went begging, the Biden administration celebrated the successful leasing of new properties for wind energy toward its "goal of deploying 30 gigawatts of offshore wind energy capacity by 2030." It is not difficult to connect the dots. Private firms know that it pays to invest only in energy sources that have government support, and to shy away from those projects that do not.

At this point, the administration does have its own plan to increase fossil fuel supplies, which is to release one million barrels per day from the nation's reserve of energy sources, without consulting our international partners. But this Band-Aid approach does not generate any new energy supplies, and it dips into reserves that were intended for short-term emergencies when it is not possible to gear up production. This unwise approach plays into the hands of people like John Kerry, who thinks that "the climate crisis cannot take a backseat to short-term fossil fuel growth while the world figures out the energy crunch." That is no excuse for many government initiatives, including the misconceived mandatory disclosure program of the Securities and Exchange Commission for climate related investments.

Other actions taken on the energy front by the Biden administration are every bit as destructive. The administration and its allies think that the key need under these circumstances is to rein in what misguided pundits like Robert Reich call the "staggering profits" made by large oil companies in the face of current global shortages of energy, and thus this coalition eyes the passage of some windfall-profit tax on oil and gas. The current proposal of Senator Sheldon Whitehouse (D-RI) and Representative Ro Khanna (D-CA) would strip away from producers a substantial portion of their gains by imposing a tax of 50 percent on any profits that are over a $66 baseline, equal to the average price for a barrel of oil in the 2015–19 base period. This tax would apply even to companies that have suffered taxable losses during this period, and thus would operate as an excise tax whose only consequence could be to induce the targeted firms to cut back on their production, thereby exacerbating the current malaise.

One equally unwise possibility is the Democratic proposal to prohibit an increase in prices whenever the president (currently Biden) declares that there is an energy shortage. People who advocate for such a proposal have short memories of the long queues that developed throughout the United States when then-president Richard Nixon put caps on oil and gas prices. The price caps generated long lines at the pumps while benefiting foreign producers who faced less new entry from the United States.

The illusion behind both proposals is that somehow the oil and gas companies have (in a deconcentrated industry), the power to dictate prices. This theory purports to explain the current price increases, but a quick look at this Bloomberg graph shows that it cannot explain the equally precipitous declines:

The only way to stop the excessive prices is to increase fuel supplies in global and domestic markets, as these political efforts to get even with alleged price gougers will only prolong the crisis. Unfortunately, led by Chuck Schumer and Nancy Pelosi, the Democrats are instead determined to take the wrong way out–all because they refuse to expand supply to meet rising demand.

In addition to the misconception that fossil fuel companies have the power to control prices, a second flawed justification is that major interventions, which foreclose the option of increasing supply, are needed to control harmful environmental externalities. There are two elementary propositions at play. First, that it is necessary to take into account the substantial externalities that arise when solar panels chew up a large portion of the landscape. Solar generation will require, by one estimate, some 8,800 square miles of land to reach the Biden administration's goal of deriving some 40 percent from solar sources by 2035. Second, that those losses are just a down payment on other externalities that arise from solar, such as having to mine for exotic rare earths on one end and to dispose of used facilities on the other. Wind presents a similar story, where the dead birds, the noise levels, the visual blight, along with the high costs of fabrication, construction, and decommissioning must also be taken into account. Shockingly, there is no mention of these costs in any of the Biden administration documents.

Ironically, the same can be said of the administration's near-obsessive concern with the effects of climate change, because these are largely ignored as well. There is rarely any mention of the positive effects of climate change, for the rise in carbon dioxide levels is associated with an increase in global greening, which makes extremes in temperature less likely. Nor is there any discussion of exactly how the measures now in place will reduce total emissions, much less the effect that this reduction will have on overall global temperatures, given that the Chinese have decided to expand their reliance on clean coal. Nor are the voluntary efforts by American firms to address climate change given much weight. Instead, there are just statements that since this is the sixth-warmest year globally, the doom must be greater than ever, even though the plateau at current temperatures is not likely to produce major catastrophes. Once again, there are wild gyrations in annual losses from natural catastrophes, which suggests that smallish annual changes in carbon dioxide levels cannot account for the variation.

A coherent energy policy cannot merely posit huge losses from climate change in some indefinite future, but instead should seek to estimate how the Biden administration policies will fare when the full range of effects from all sources is considered. We know that the market losses from shunning fossil fuels are enormous. What evidence is there that net climate change loss justifies those losses? The Biden administration won't say.

Richard A. Epstein