The Federal Reserve's encouraging September report on U.S. household wealth should bring some comfort to those concerned over American families' ability to deal with Fed efforts to corral inflation and the slowing economy that may follow. Consumers are sitting on a lot of wealth, including cash, even as slowing asset growth may gradually make things more difficult. But this (mostly) good news also suggests the battle against inflation should be broadened.

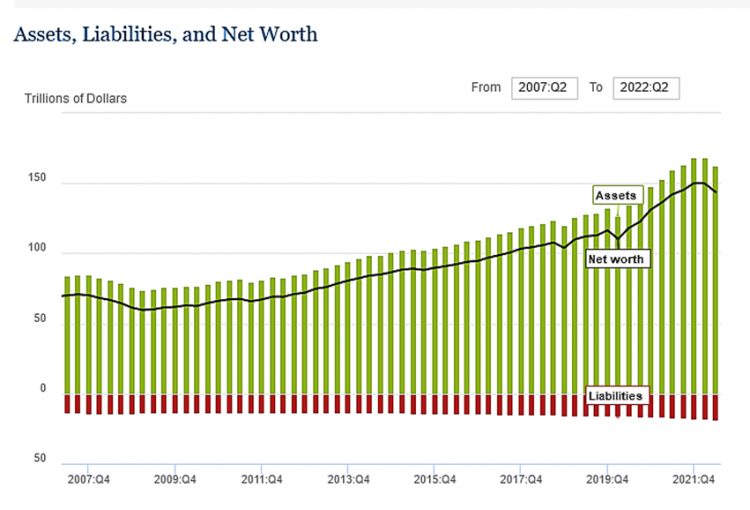

The nearby chart, taken from the report and covering the past 15 years, shows how the level of household assets and net worth accelerated in 2020 and peaked in late 2021 as stimulus checks made their way into consumer bank accounts. Notably, the value of real estate and cash rose significantly along the way while stocks and bonds were falling in the most recent quarter.

Federal Reserve

Yet we still have cash, and not just the wealthy households. A Wells-Fargo analysis of the report indicates that "cash assets of the bottom half of the population by wealth are 49% higher compared to the end of 2019, while the top 1% have seen a 54% gain, indicating a consistent rise in cash since the end of 2019." The report estimates current "excess" savings at $1.3 trillion. To put this in perspective, I note that total retail sales for the U.S. economy in 2021 were $6.6 trillion.

Put another way, U.S. consumers still have a substantial savings shock absorber that can keep them shopping on into 2023, in spite of higher interest rates and the looming slowdown.

Of course, all eyes remain on the Fed and its struggle with inflation. Raising interest rates to the point where the economy and employment growth slows places the focus on curbing the demand side of the economy. Yet if consumer demand, fortified by excess savings, remains high and people keep buying despite higher interest rates, inflation will remain stubborn. This suggests that the policy spotlight should be directed to shine brighter on the economy's supply side.

What might Washington policymakers do to free up supply? Can the economy deliver more goods to meet demand and thereby bring down inflation? The Fed can't achieve this alone.

First off, tariffs, quotas, and other trade barriers should be rolled back. For example, the extra layer of aggressive trade restrictions that emerged during the Trump administration should be hung out to dry. Fighting property rights infringement or forced labor is one thing; limiting the flow of lower-cost goods to Americans is another.

Then, more attention should be devoted to the work of the White House Office of Information and Regulatory Affairs (OIRA) to reduce executive branch overreach. OIRA should make more effort to replace command-and-control, "do it this way" regulations with rules based on objective performance standards. A straightforward focus on accountability and outcomes encourages competition to discover better and cheaper ways to achieve goals like improved energy efficiency or consumer safety.

Finally, antitrust authorities should be more friendly to proposed vertical mergers of companies that occupy different parts of the production chain, which generate cost savings in the production and delivery of goods to consumers. Typically, we should be less concerned about monopolization resulting from these transactions than with horizontal mergers that join one competitor with another.

When it comes to fixing inflation, we need to remember there are two sides to the economy. While the Fed focuses on demand, Congress and the Biden administration must set their sights on supply. And all must be held accountable for easing out inflation while preserving our bank accounts.

Bruce Yandle is a distinguished adjunct fellow with the Mercatus Center at George Mason University, a dean emeritus of the Clemson College of Business and Behavioral Sciences, and a former executive director of the Federal Trade Commission.